Lounge Access

The lounge access is very similar between both options, as they both offer Priority Pass lounge access that does not include restaurants, although there are a few differences, listed below:

The ability to add AUs for free, the addition of Plaza Premium, and the fact that you can still use the Chase lounges once per year make the Venture X the clear winner for lounge access.

Travel Insurance & Protections

Travel Credits

Both Chase cards have additional credits, such as complimentary Dashpass through the end of 2024 on the CSP and CSR, $5 per month of Doordash credit, and 2 years of Lyft Pink through the CSR. I am not considering these credits since they are generally not considered to be valuable, but you may choose to consider them when calculating your effective annual fee if they happen to align with your typical spending habits.

Both options have a $300 travel credit, but they function differently. The CSR credit is very flexible and will be triggered by most things in the travel category. The Venture X travel credit is only able to be used when booking with the Capital One travel portal.

The Venture X also gives you 10,000 miles each year on your cardmember anniversary, which has a minimum value of $100, although it is likely that you can use them for much better value through transfer partners.

The CSP has a $50 hotel credit that, similar to the Venture X credit, is restricted to use in the Chase travel portal for hotel bookings.

Effective Annual Fees

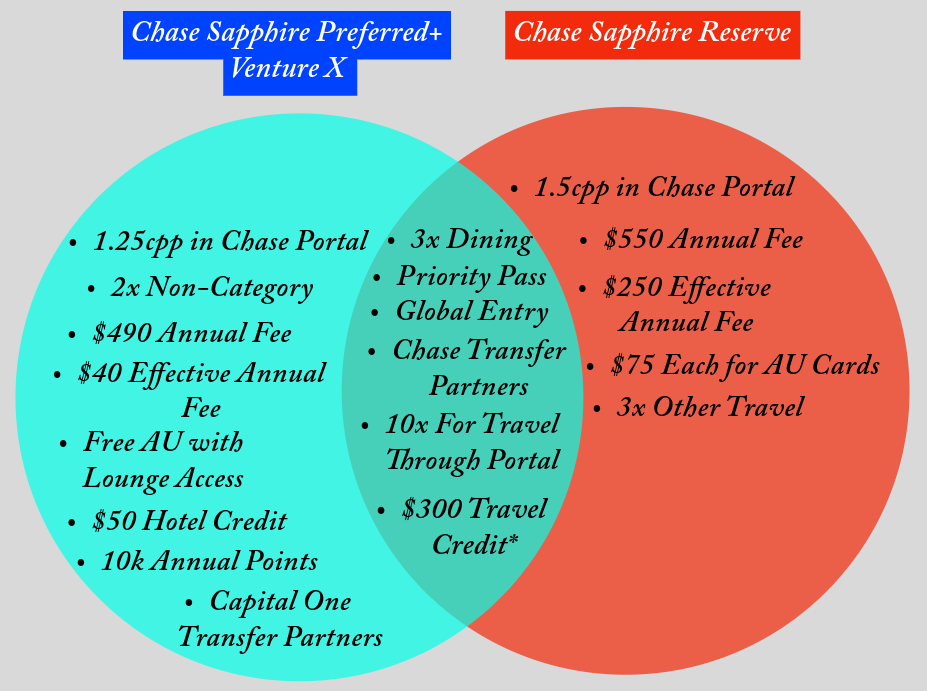

The CSR has an annual fee of $550, while the CSP/ Venture X option has a combined annual fee of $490 (Venture X: $395; CSP: $95)

The CSR has $300 of credits that help offset the annual fee, giving us an effective annual fee of $250.

The CSP/ Venture X have a combined $450 in credits, giving us an effective annual fee of $40. Some people may choose to ignore the CSP hotel credit due to its restrictive terms. This gives us an effective annual fee of $90, which is still much lower than the CSR.

Final Thoughts

In my opinion, the CSP and Venture X is the best option by far. For $60 less in annual fees you receive access to an additional lounge network, the ability to gift lounge access at no additional cost, an extra $100-$150 in useful travel credits, and access to 2 transferable currencies instead of one.

The biggest downsides are that you get 1.25 cents per point in the Chase travel portal vs. the 1.5 of the CSR and that you only get 1 visit per year to Chase lounges.

Generally, using points in the portal is considered poor value, so the 0.25 cent difference likely won’t matter unless you are redeeming 100,000+ Chase points through the portal each year.

If Chase Sapphire lounges are particularly valuable for you, I would recommend applying for the Marriott Bonvoy Boundless card and product changing after 1 year to the Ritz-Carlton card (closed to new applicants), as that card also provides unlimited access to Chase Sapphire lounges, has an annual 85,000 point free night award, and a $300 airline incidental credit for a $450 annual fee. This makes it a much better way to access that lounge network. (It also has the same travel protections as the CSR, if that is something you are concerned about missing with the CSP/ Venture X.)

Leave a Reply