Background on the BOI Report

- Who Is Required to File

- Who is a Beneficial Owner

- When Does the Initial Report Need to be Filed

- When Do BOI Reports Have to be Updated?

- Penalties Associated with BOI Reporting

Guide to the BOI Report

Background

What is a Beneficial Owner Information Report?

The Corporate Transparency Act, passed in 2021, created a requirement for companies to report direct or indirect owners, to make it more difficult to benefit from ill-gotten gains through the use of shell companies or other opaque ownership structures.

Some accountants believe this could potentially be considered practicing law, and even some that don’t are concerned about the possibility of very steep penalties.

FinCEN does not seem to believe that it is practicing law, and considering how straightforward the form is, I will be filing them for my clients. For people who partner with accountants that are choosing not to file the form, this post can serve as a guide to help you easily file the report yourself.

Who is Required to File?

Any entities created by the filing of a document with a secretary of state

or any similar office in the United States are required to file a BOI report, with the most common types being limited liability companies (LLC) or corporations. In addition, foreign companies that are registered to do business in the US are also required to file a BOI report.

There are 23 exceptions, with almost all of the exceptions being for businesses that are in heavily regulated industries, such as banking, securities, or insurance companies.

Who is a Beneficial Owner?

A beneficial owner is any individual who owns or controls at least 25% of the ownership interests in a reporting company or exercises substantial control over the company.

Although beneficial owners are generally individuals, there are 2 scenarios where a company can be listed as a beneficial owner of the reporting company:

- A reporting company may report the name(s) of an exempt entity or entities in lieu of an individual beneficial owner who owns or controls ownership interests in the reporting company entirely through ownership interests in the exempt entity or entities; or

- If the beneficial owners of the reporting company and the intermediate company are the same individuals, a reporting company may report the FinCEN identifier and full legal name of an intermediate company through which an individual is a beneficial owner of the reporting company.

- This is the most common of the 2 scenarios and will generally apply when a holding company is the sole owner of a subsidiary, and the list of beneficial owners is identical between the 2 companies. In this case, the subsidiary has the option to report the holding company as the beneficial owner, since all of the beneficial owners’ information was already reported on the holding company’s BOI report.

- Considering how simple this form is to complete (especially if all beneficial owners have chosen to get FinCEN numbers), I feel like connecting multiple BOI reports together is pointless, and only serves to complicate things for the vast majority of companies.

- This is the most common of the 2 scenarios and will generally apply when a holding company is the sole owner of a subsidiary, and the list of beneficial owners is identical between the 2 companies. In this case, the subsidiary has the option to report the holding company as the beneficial owner, since all of the beneficial owners’ information was already reported on the holding company’s BOI report.

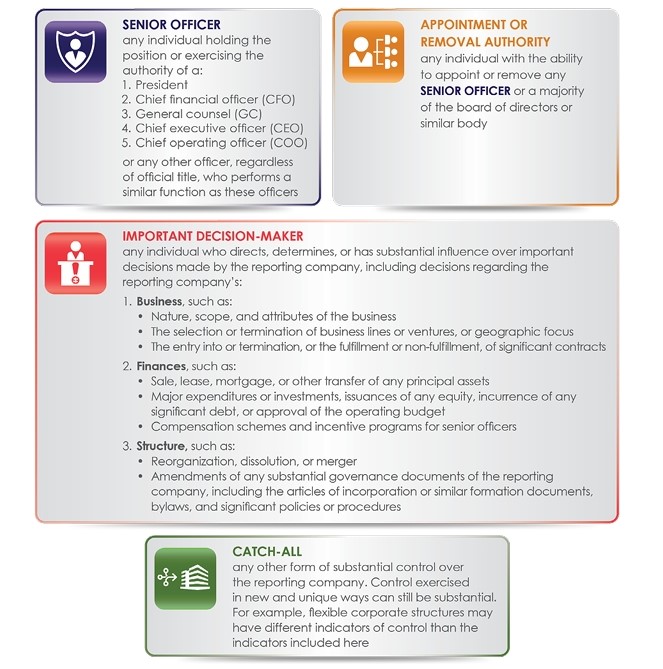

What is Substantial Control?

Generally, an individual who has substantial control falls into one of the following categories:

When Does the Initial Report Need to be Filed?

This deadline will vary based on when the company was created, with the following deadlines:

- For companies created before January 1, 2024, the deadline to file the BOI report is January 1, 2025

- For companies created in 2024, the deadline is 90 days after the company receives notice that its registration is effective (for people who register with their Secretary of State online, you will likely receive notice immediately, which starts the 90-day clock)

- For companies that are formed on or after January 1, 2025, the deadline is 30 days after receiving notice that the registration is effective.

When Do BOI Reports Have to be Updated?

Generally, BOI Reports need to be updated within 30 days, but when the 30-day clock starts will depend on the type of change that occurred.

- When information changes, a new report needs to be filed within 30 days of the change.

- When a beneficial owner dies, the 30-day clock doesn’t start until the deceased owner’s estate is settled.

- When there is an inaccuracy on the report, it needs to be corrected within 30 days after the date your company became aware of the inaccuracy or had reason to know of it.

Penalties Associated with BOI Reporting

The penalties for willful failure to file a complete and accurate BOI report is up to $591 per day (adjusted annually for inflation), or criminal penalties of up to 2 years in prison and/or a $10,000 fine.

Exception: If a person has reason to believe that a report filed with FinCEN contains inaccurate information and voluntarily submits a report correcting the information within 90 days of the deadline for the original report, then the Corporate Transparency Act creates a safe harbor from penalty.

The wording of this portion of the CTA seems to suggest that there may be some capacity for the penalties to be reduced or completely abated, particularly if you can show that not filing/ updating the report was an oversight, rather than a willful act, but there is no clear answer yet as to how lenient they are likely to be.

Beneficial Ownership Information Report

Although the penalties are certainly intimidating, the report itself is not, and for most small businesses, it shouldn’t take more than 10 minutes.

FinCEN ID

A FinCEN ID is a 12-digit number that can be used as a substitute for the information in the Company Applicant and Beneficial Owner sections. This is optional but may be more convenient if you need to be listed on multiple BOI reports.

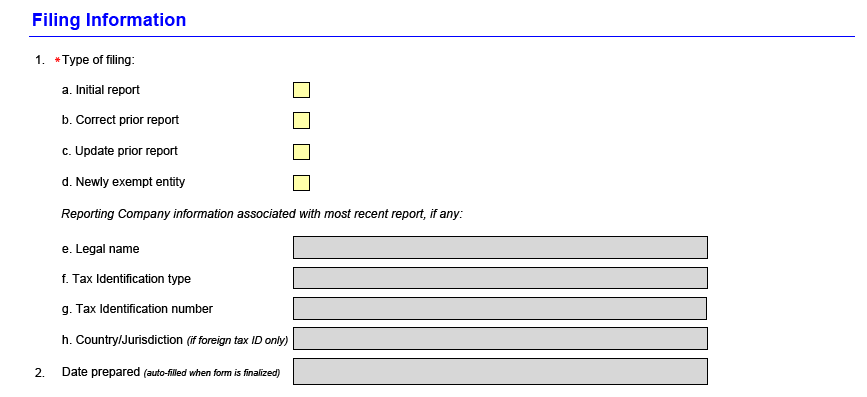

Filing Type

You select which type of report you are filing, with the options being as follows:

- Initial Report

- Correct Prior Report

- Update Prior Report

- Newly Exempt Entity

If you select anything other than Initial Report, you will fill out the following information as it is listed on the most recent report:

- Legal Name of Company

- Tax Identification Type

- Tax Identification Number

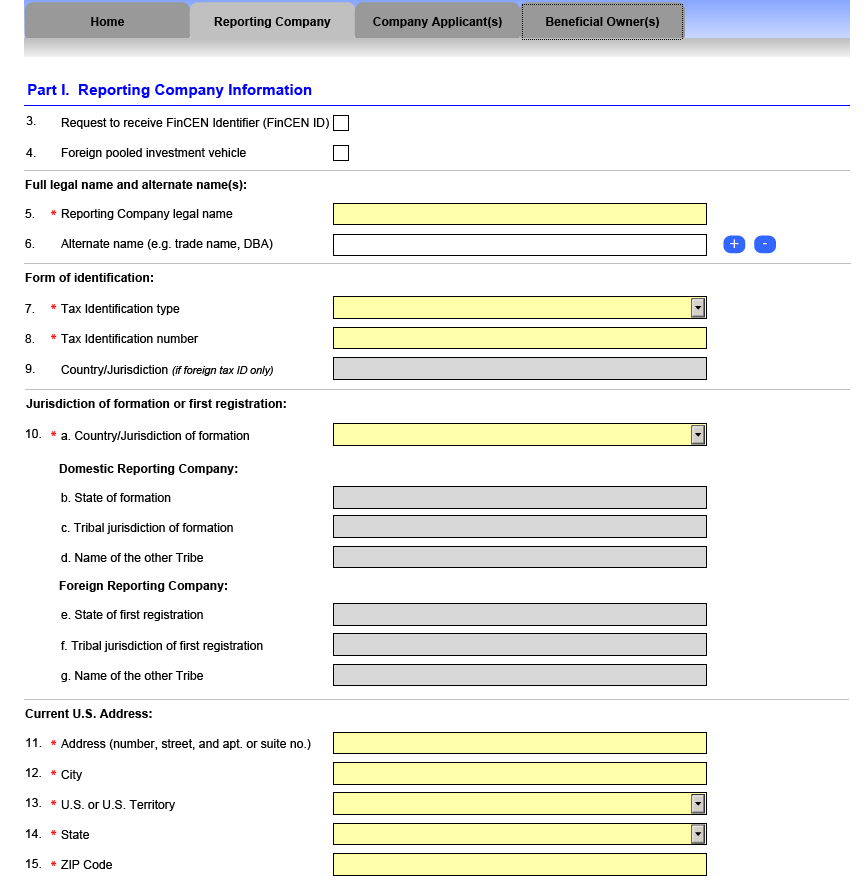

Reporting Company Information

This section covers the following information regarding the company:

- Legal name of the company, as well as any alternate names, such as DBA names or trade names

- Tax ID type and Tax ID number

- Country and state of formation

- Current address of the company

- Whether the company was created prior to January 1, 2024

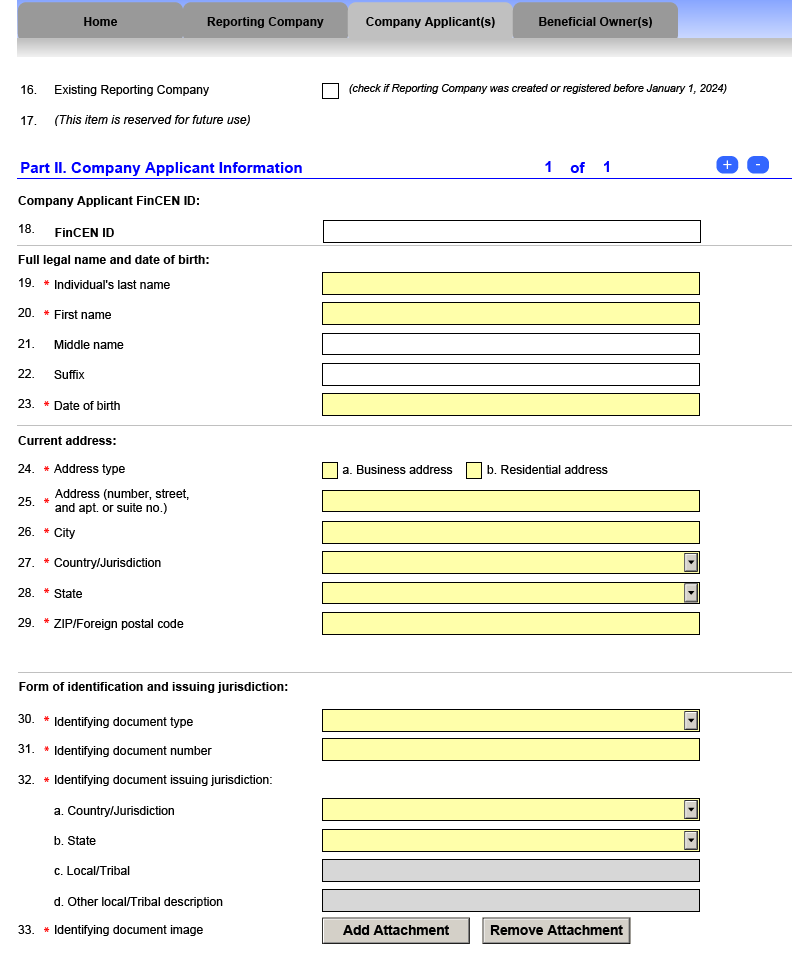

Company Applicants

A company applicant can fall into 1 of 2 categories, and can include up to 2 people:

- The individual who directly files the document that creates or registers the company, and

- If more than one person is involved in the filing, the person who is primarily responsible for directing or controlling the filing.

Note: This section does not apply to businesses formed before January 1, 2024

Company applicants will need to provide the following information, unless they choose to provide their FinCEN ID as an alternative:

- Full legal name and date of birth

- Address

- Form of Identification, and the options are as follows:

- State-issued drivers license

- State/local/ tribe-issued ID

- US Passport

- Foreign Passport

- ID Number

- If you use a form of ID other than a US passport, you will need to provide the country/ state of the issuing jurisdiction

- A scanned image of the ID used for this section of the report

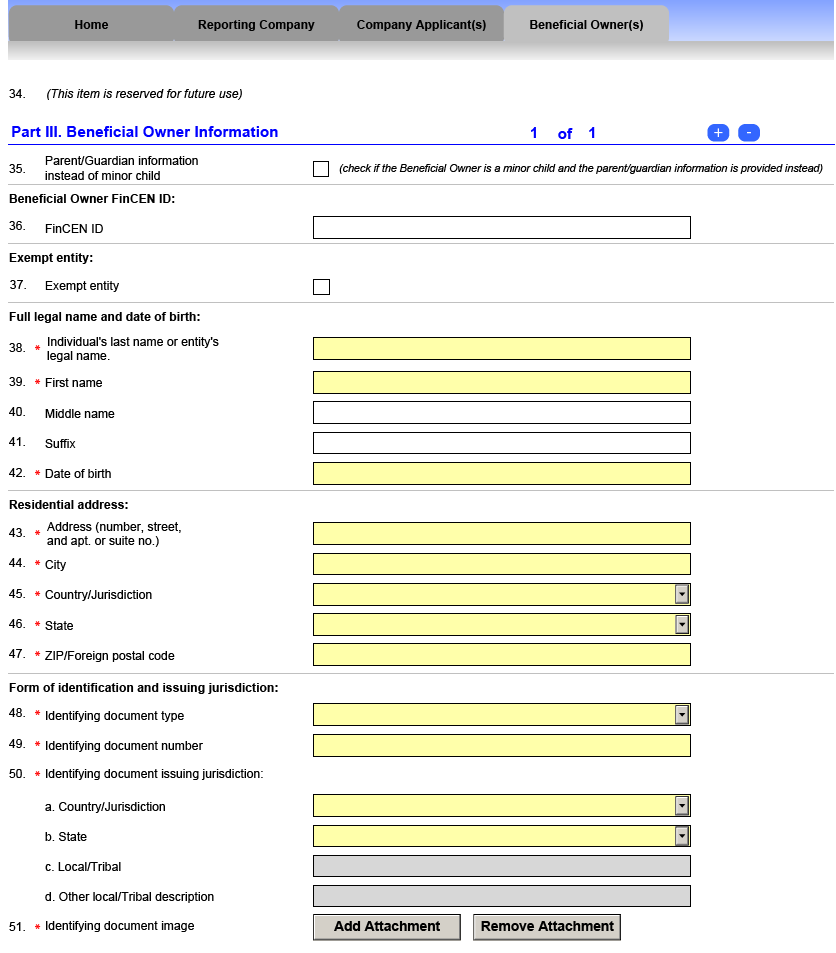

Beneficial Owners

The information in this section needs to be provided for anyone who meets the definition of a beneficial owner, and is identical to the information required for company applicants in the previous section.

- Full legal name and date of birth, or entity’s name, if the beneficial owner is a business entity

- Address

- Form of Identification, and the options are as follows:

- State-issued drivers license

- State/local/ tribe-issued ID

- US Passport

- Foreign Passport

- ID Number

- If you use a form of ID other than a US passport, you will need to provide the country/ state of the issuing jurisdiction

- A scanned image of the ID used for this section of the report

Leave a Reply