What Are Card Linked Offers?

Card linked offers are promotional offers that allow you to receive a rebate for specific merchants, typically in the form of cash back, although some offers will give you points instead. These offers can be separated into 2 types: credit card merchant offers and card linked offer portals.

Credit Card Merchant Offers

These types of offers are activated when you log in to your online banking dashboard, and most, if not all, of the major credit card issuers have these offers.

Generally, offers are linked to a particular card with the main exception of Wells Fargo Deals, which are activated once and will be used on the first qualifying purchase made with any Wells Fargo credit or debit card.

Most often, these offers will give you a percentage rebate on your spend as a statement credit, usually up to a maximum amount. American Express, in addition to offering cash back offers, will sometimes have offers that give you an added multiplier, such as an offer for +1x Membership Rewards points on spend at a particular merchant, in addition to the base earnings on the card.

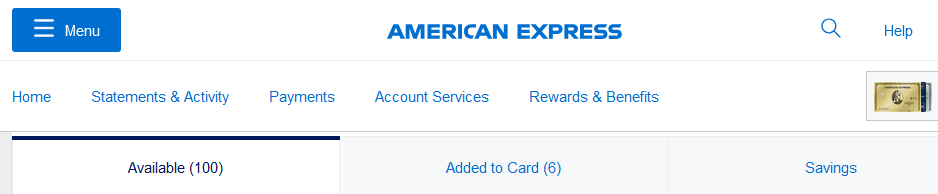

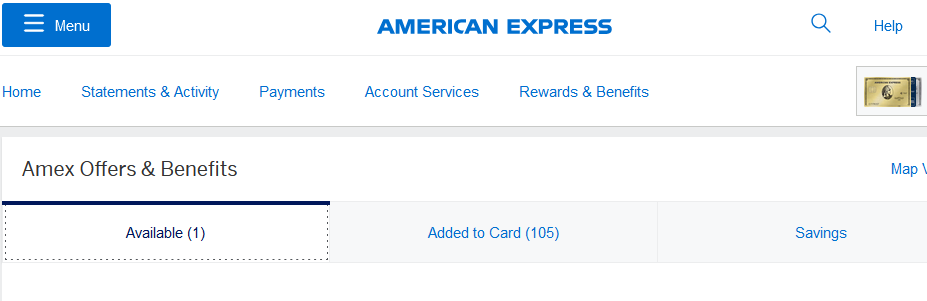

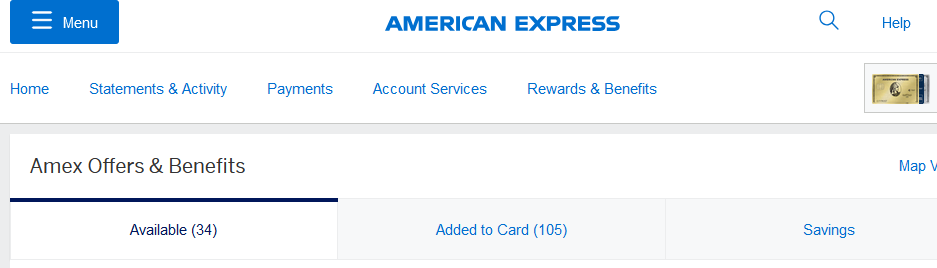

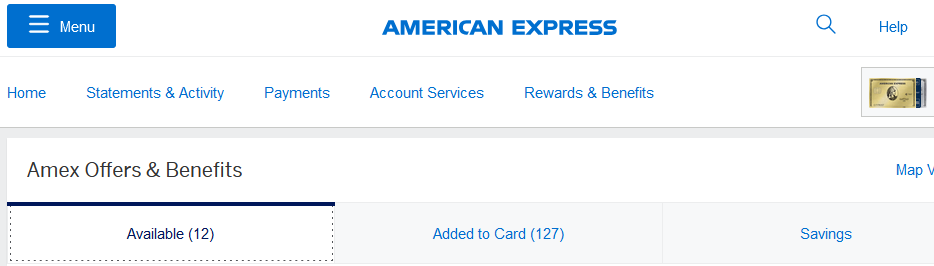

Note: Amex Offers only shows 100 offers at a time, even when there are more than 100 offers available. Once you activate all of the offers, you can exit the website and log back in, and you may see additional offers, as shown below.

Offer Portals

These are 3rd party websites that allow you to link your cards to their website and activate offers, and they will be used when you use any of your linked cards for an eligible purchase. Most dining programs fall into this category, as well as the following:

- SimplyMiles (only Mastercard can be linked) which earns American Airlines miles

- Rakuten, which can earn cash back or Amex MR points, if you have an MR earning card linked to Rakuten and choose to earn that way. If you choose to earn in the form of MR points, you will earn them for every purchase, even if you don’t use an Amex card.

- Jet Blue Shopping, which earns TrueBlue points.

- Visa Savings Edge, for Visa business cards

- Mastercard Easy Savings, for Mastercard Business cards

There may be other options for 3rd party card linked offer portals, but these are the most popular options.

Can You Stack Multiple Offers?

Multiple 3rd party offer portals cannot be used for the same purchase. If you see multiple credit card merchant offers showing on the same card, it is likely that they will stack, but make sure to read the terms as sometimes in-store and online purchases will have separate offers that can’t stack.

If you have an offer from a 3rd party offer portal that coincides with a credit card offer it’s likely that they will stack, although you may run into issues occasionally if the bank uses the same backend software as the portal.

An example of this is SimplyMiles and Citi Merchant Offers. Both of these programs use the same backend software, and generally won’t stack. With this combination in particular if you activate the offer with Citi, you may end up getting an error message when you attempt to activate it with SimplyMiles. They have stacked in the past, and it may work occasionally, but I would check both and determine which offer is best and activate the highest offer first, since you can’t deactivate an offer and activate the other one if it doesn’t allow both to be stacked.

Other Stacking Options

While you are generally limited to 1-2 card linked offers, you can stack them with shopping portals when making online purchases. For example, I often stack a credit card offer, SimplyMiles, and AAdvantage Shopping to maximize rewards. On a few occasions, the rewards have been high enough to be better than free. One of the best examples of this is Blue Apron, for which I had the following offers:

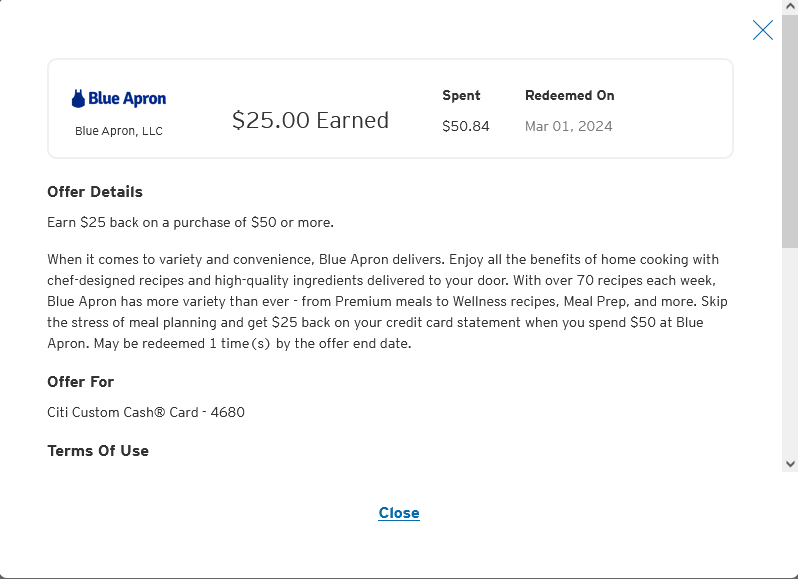

- Citi Merchant Offer for $25 back after spending $50+

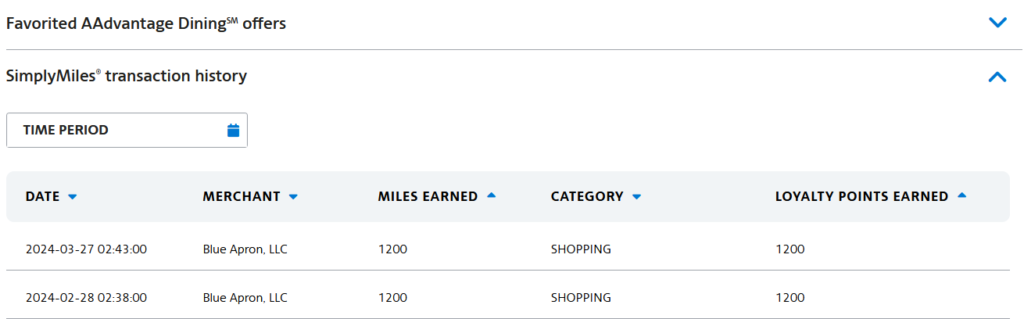

- SimplyMiles Offer of 1200 AA miles after spending $50+

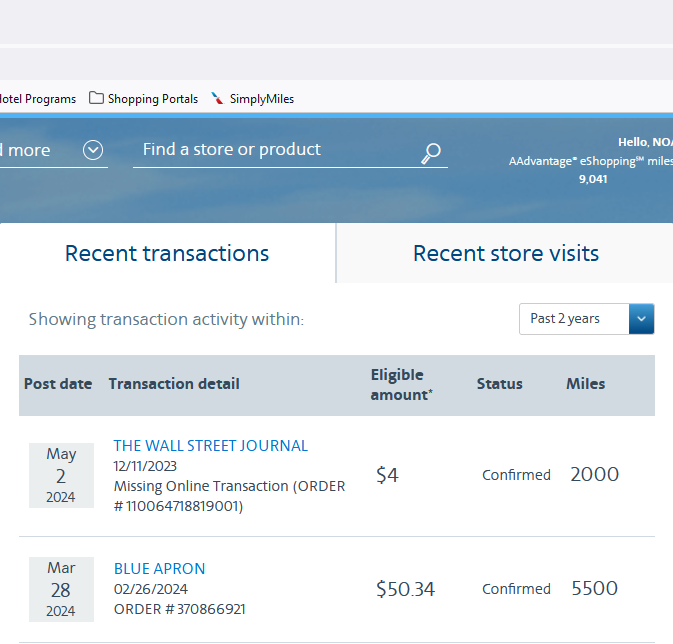

- AAdvantage Shopping fixed mile offer of 5500 AA miles

I spent $50.84 and received $25 and 6700 AA miles, effectively purchasing the miles at 0.39 cents per point while also receiving 4x 4-person meal kits. I view that as buying miles at a very steep discount, with the products just being a bonus, since I would be willing to buy AA miles for less than a half of a cent each without hesitation.

In addition, while not exactly a stack, you can purchase gift cards for merchants that you know you’ll use in order to save the offer for a later time, or to be able to use it across multiple purchases. Generally this works best for in-person transactions, since many online retailers don’t process their own gift card sales, and therefore won’t trigger the offer.

Leave a Reply