Credit Card Overview

Signup Bonuses

While you can certainly earn 2x-5x on everyday spend, the best way to earn large numbers of points quickly is to sign up for several cards per year and earn the signup bonus, which can be 10x or higher in some instances.

Card Benefits

Some people don’t like the idea of paying an annual fee for a credit card, but there are times when it makes sense. Paying the fee in the first year will almost always make sense, since you’ll receive the bonus. In addition, some cards have benefits that allow you to get value in excess of the annual fee. Cards like this are referred to as keeper cards. What may be a keeper card for someone else may not be for you, since you may not value the same benefits in the same way.

Keeper Cards

There are a few different types of keeper cards, that you may find valuable:

- Hotel cards: These are cards that give you a free night certificate or a set amount of points each year, that can be used for stays that are worth more than the fee.

- Airline cards: Airline keeper cards are cards around $100-$150 per year that include benefits such as free checked bags, priority boarding, limited lounge access, or discounts on in-flight purchases.

- Premium travel cards: These cards generally have an annual fee of $400 or more and include statement credits and some form of lounge access. Most airlines and hotels have premium cards that give you the benefits mentioned earlier, but these benefits are generally better, with more checked bags for airline cards or a higher value free night for hotel cards.

- Cards that unlock transfer partners: These cards don’t provide credits or benefits to offset the annual fee, but they are necessary to enable using transfer partners. The only programs that require an annual fee card to use transfer partners are Chase Ultimate Rewards and Citi Thank You Points.

- The cards in this category are the Chase Sapphire Preferred or Chase Ink Business Preferred, and the Citi Strata Premier. All of these cards have a $95 annual fee.

Redemptions

How Awards are Priced

Award Charts

Award charts make pricing more predictable, and is the ideal, especially when booking trips during high-demand times, since the award price isn’t going to be greatly affected by changes in the cash price. Most award charts have peak, standard, and off-peak pricing, so there will be some fluctuation throughout the year, and sometimes awards will change categories to devalue the award, but those changes tend to be relatively small when compared to dynamic pricing.

Award Chart Examples

Aer Lingus

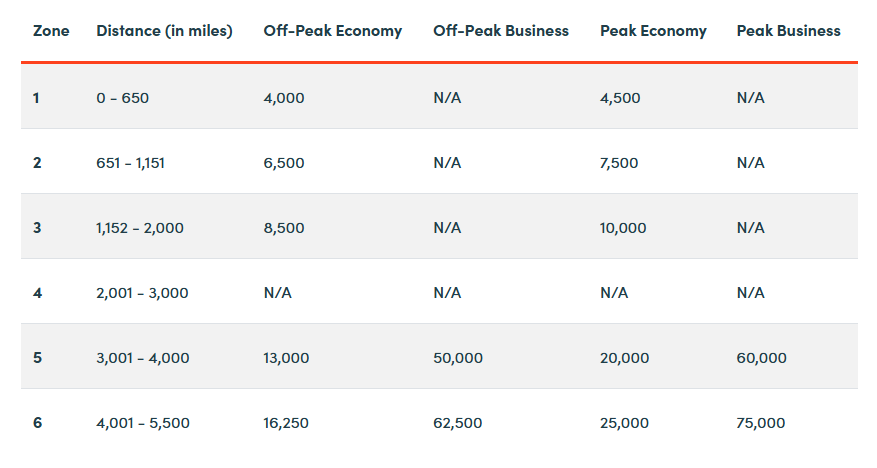

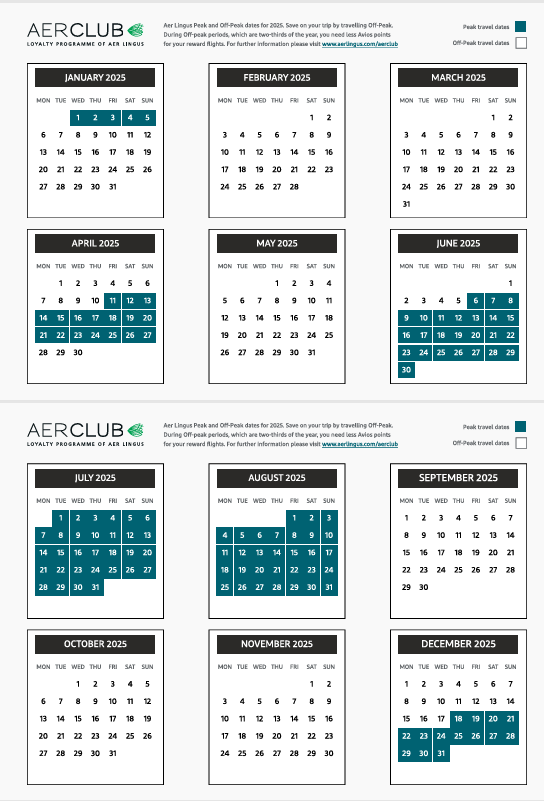

Aer Lingus is the flag carrier of Ireland. They use the Avios points program, and they have a fairly simple award chart that is based on the flight distance, as well as whether the travel dates are peak or off peak.

Image Source: https://10xtravel.com/aer-lingus-aerclub-award-charts/

Image Source: https://www.aerlingus.com/media/pdfs/AC_calendar_2025.pdf

Hyatt

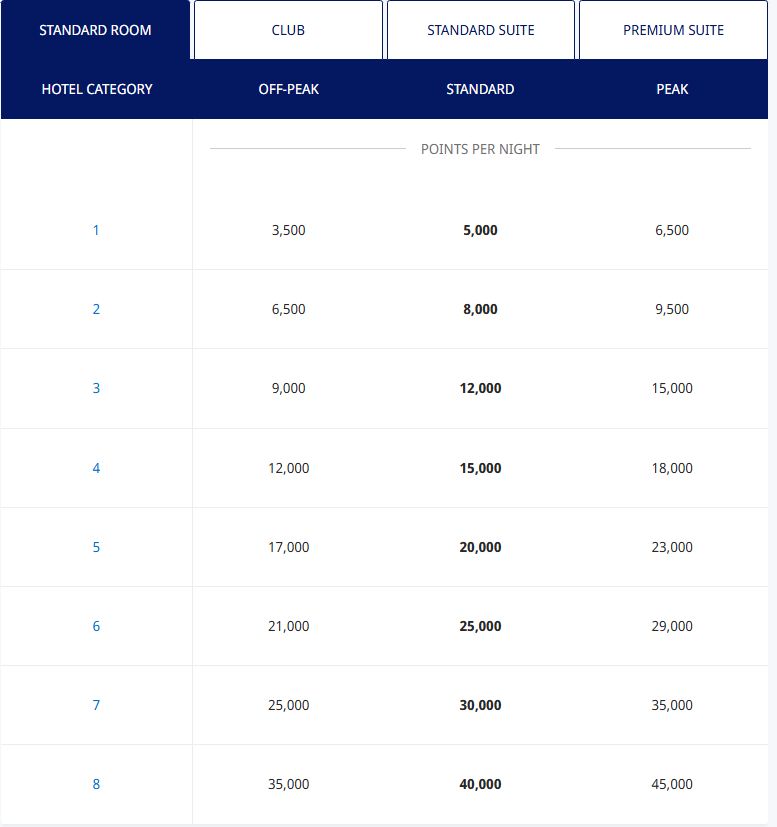

Hyatt Hotels is one of the only hotels that still uses an award chart. There are separate award charts for all-inclusive resorts and Miraval resorts. Each hotel is given a category of 1-7 for the regular award chart and A-F for resorts. There are also separate award charts depending on the room type. Unlike Aer Lingus, the peak, standard, and off-peak dates are not consistent, and will vary by hotel.

View all Hyatt award charts here: https://world.hyatt.com/content/gp/en/rewards/free-nights-upgrades.html

Dynamic Pricing

When the award price is tied to the cash price of a flight or hotel stay, this is referred to as dynamic pricing. It is often the case that awards booked with programs that use dynamic pricing will have lower value when figuring the value using cents per point (CPP). With many programs, it is still possible to find value that is higher than expected by focusing on saver awards, which will be discussed below in more detail.

Saver Awards

Saver awards are lower cost awards, and they are the key to unlocking outsized value. Saver awards are more common during off peak times of year, although they can appear randomly during times where flights typically have a more expensive cash price.

In addition to lower points prices, saver awards are particularly useful because they are more likely to be released to partners, including to partners who use an award chart for partner bookings, which means that you may be able to book the exact same flight while using fewer miles.

Airline Alliances

Airlines partner with each other to be able to sell flights on other airlines, referred to as codesharing, but the closest partnerships are within alliances. In addition to having codeshare flights, each member airline’s status tiers are tied to a status level within the alliance, and you will receive some status benefits when flying with other members of that alliance. these benefits can include free checked bags, priority boarding, lounge access, and more. Each alliance and their member airlines are shown below.

One World Alliance

Star Alliance

Sky Team Alliance

Stacking Opportunities

What is Stacking?

Stacking is the process of combining multiple promotions and offers to reduce the cost of a purchase or maximize the rewards that you earn for a particular purchase. Below, I’ll list a few of my favorite tools to stack rewards, as well as a few examples of successful stacks.

United MileagePlusX

This is an app that you can use to purchase gift cards, and you will earn between 0.5-10 United Airlines miles per dollar spent. Most stores available through this app offer 1-5 miles, with some promotions bringing the offers up to 10, and popular merchants such as Walmart, Best Buy, Chipotle, and Kroger generally staying around 0.5 miles per dollar. Generally, you can purchase a gift card for any amount that are within the minimum and maximum values for that merchant, so you can purchase a gift card after you know your total, to avoid having gift cards with a remaining balance.

In addition to the miles earned through the program, you will receive the base earning for your credit card, with the exception of Chase. Due to the partnership between Chase and United Airlines, you will earn credit card rewards as if you made the purchase directly with the merchant. For example, if you purchase a Jersey Mike’s gift card through MPX with the Chase Sapphire Preferred, you will earn 3x as a dining purchase, rather than the 1x you would typically earn for non-category spend.

SimplyMiles

SimplyMiles is a program offered by American Airlines that allows you to link any Mastercard credit card, debit card, or gift card, and activate merchant offers. These offers will be in addition to any merchant offers that you activate with the bank (although there may be issues stacking this with Citi Merchant Offers, since they use the same backend program, which can cause an error message when attempting to activate the offer in both places.)

In addition to miles earned, you generally receive 1 loyalty point for every mile you earn, which can help qualify for American Airlines status.

Merchant Offers

These offers are available directly with the issuing bank of your credit or debit cards. These offers are generally in the form of cash back as a percentage of spend up to a maximum rebate, although Amex Offers sometimes offer a set amount of points for a purchase of a minimum amount, or an extra multiplier up to a maximum spend.

Shopping Portals

A shopping portal is a website that contains links to merchant websites, and the shopping portal earns a commission for driving traffic to the merchant, and they pass part of this commission onto you, in the form of either cash back or miles.

Some people recommend using Cashback Monitor to find the most cash back possible for any merchant, but I prefer to stick with 2 trusted options: Rakuten and AAdvantage eShopping.

Rakuten

Rakuten is a shopping portal that advertises rewards as cashback that can be redeemed as a check in the mail or through PayPal. However, if you have an American Express card that earns Membership Rewards points, you can choose to earn MR points at a rate of 1 cent per point. Depending on how you redeem MR points, this method of earning can be significantly more valuable than cash back.

Rakuten regularly runs limited-time promotions where rewards may be double or triple, or they may run deals where several stores have the same earning rate. Some promotions are only available through the mobile app, so it is worth having the app and checking stores that you regularly order from.

Rakuten affiliate link: Currently, the offer is to receive an extra $30 (3,000 MR points) when you spend $30 within the first 90 days of joining.

AAdvantage eShopping

This shopping portal earns American Airlines Miles, and generally you will earn 1 loyalty point towards status per mile earned. Based on how I redeem points and how I value status, I tend to favor this option over Rakuten when the earning rates are similar.

AAdvantage eShopping Link: This is not an affiliate link, and there is not currently a bonus for joining.

Stacking Examples

Blue Apron

- Citi Offer: Earn $25 back on a purchase of $50+

- SimplyMiles: Earn 1,200 miles on a purchase of $50+

- AAdvantage eShopping: Earn 5,500 miles on your first purchase.

- Blue Apron coupon code: 75% off the first order

I ordered 4x 4-person recipes, which have a regular price of $154.83 including shipping. With the discount, I paid $50.84, I received a $25 statement credit, so I effectively paid 0.39 cents per AA mile. If AA miles ever went on sale for this price, I would buy as many as possible and I would not have otherwise ordered Blue Apron, so I view it as buying AA miles and getting free food, rather than paying for the food.

Peet’s Coffee

- Amex Offer: Spend $30+, earn 1,500 additional Membership Rewards points

- AAdvantage eShopping: Earn 6x with Peet’s Coffee

- Peet’s Coffee coupon code: Save 30% on a new subscription

- Subscriptions always have free shipping

I ordered 3x 1lb bags of the house blend dark roast, which has a regular price of $53.85. After the 30% discount and tax, I paid $38.07, and received 323 AA miles and 1,538 MR points.

Vistaprint

- Amex Offer: Spend $100+, earn $25 back

- AAdvantage eShopping: Earn 1.5x at Vistaprint

- Vistaprint coupon code: New customers receive 25% off their first order

- Vistaprint orders have free shipping when spending $100+

I added $134.83 worth of items to my cart, and the total after the discount code was $101.11, not counting the $25 statement credit. As a bonus, this order is tax deductible, which will give me ~$20 or so in tax savings.

Stacking Tips

- Using coupon codes that aren’t given through the shopping portal may disqualify the purchase for rewards. I have had good luck with the purchase crediting anyway, but if you don’t receive miles for a particular purchase, this could be the reason.

- Purchases made with gift cards generally won’t be tracked as purchases in a shopping portal, although I have had some purchases receive rewards even when I used a gift card. If you are using a gift card, it doesn’t hurt to click through a portal just in case it works, but if you don’t receive rewards, it’s best not to bring attention to your account by asking about the miles.

- Purchasing gift cards online generally won’t count towards earning miles. Purchasing gift cards in a store will generally appear as a purchase for merchant offers and SimplyMiles, but many stores use a 3rd party platform to sell gift cards online, so it won’t post correctly.

Leave a Reply